By this time of year, college-bound high school seniors are usually celebrating their choices, researching dorms and even thinking of their majors. This year, that’s not necessarily the case.

Because of a disastrous rollout of the new application for federal tuition aid, many still don’t know how much tuition they would be paying and so have not decided where they can afford to go.

The Education Department’s redesigned form for the Free Application for Federal Student Aid, or FAFSA, was supposed to make applying for tuition aid easier and more accessible. But faced with a bureaucratic mess caused by technical meltdowns and severe delays in processing information and receiving aid packages, students say the new system has been anything but clear or streamlined.

The first signs of trouble began in December with the form’s release and have cascaded since, creating uncertainties for students — with graduation right around the corner.

“It’s been a nightmare from point A to point B,” said Reyna Atkinson, a 17-year-old from Michigan, who ultimately committed to Michigan State University after months of waiting.

FAFSA is a free, standardized application for federal aid for college tuition that millions rely on. Students fill out one form, with details on their background and household income, to request tuition information for the schools they list.

Before the overhaul, applicants typically received their financial aid packages within 72 hours of submission. But this year, the Education Department has to reprocess more than half a million applications, and students have been waiting for two, three months — and counting.

Students typically must commit to a college by May 1. Some colleges have extended their decision days until May 15 or early June because of the FAFSA problems.

Even so, several students interviewed by The New York Times said they were making decisions without getting a full picture of tuition costs, a move financial aid experts discourage. Others said they couldn’t commit without knowing how much their chosen college would cost.

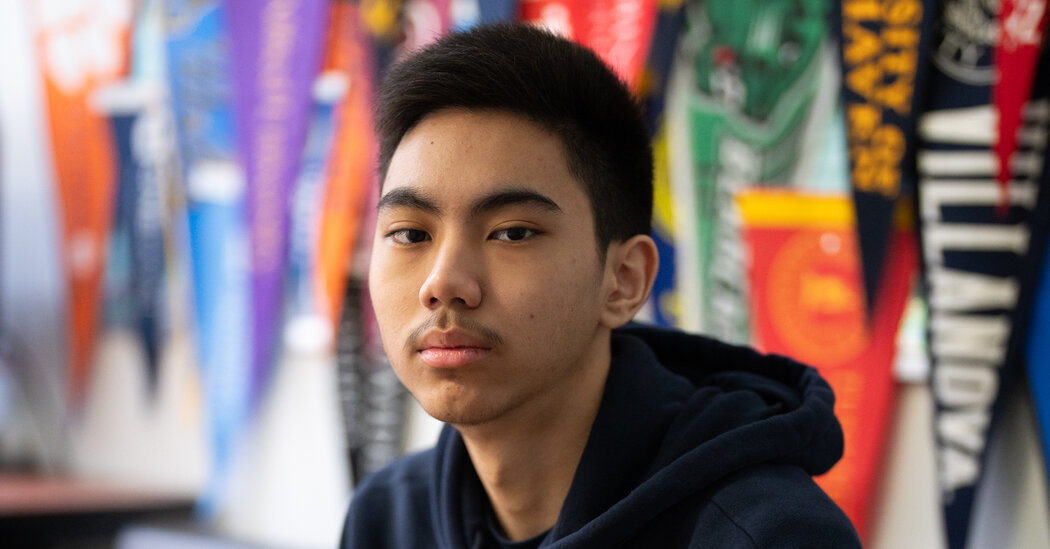

Kenneth Seinshin, a 17-year-old from New York City who hopes to be the first in his family to go to college, started filling out his application the first week it came out. But it took months to troubleshoot the glitches he encountered; he finally submitted in March.

So far, he has received only one aid package, for Union College in New York, and he has yet to make a decision. “The whole process just really stressed me out,” Kenneth said.

Clover Schwalm, an 18-year-old from Michigan, was in a similar situation. As a disabled and transgender student, she wanted a school with an accessible and inclusive environment. She still hasn’t received all of her packages, including from schools of higher priority like Savannah College of Art and Design, but committed to Arizona State.

She said she has “reservations” about moving to Arizona, but was comforted by the fact that it doesn’t have a ban on transgender care for adults. “It’s not the best, but I also recognize that there are states that could be less safe,” she said.

Simply completing the application has been a frustrating task for many. Some have not been able to save their changes or make corrections, while others could not submit their form at all.

So far this year, there has been a noticeable dip in the number of students who have completed the form, compared with last year. Among high schoolers graduating this year, 35.6 percent had completed financial aid applications through April 26, compared with 48.2 percent in the same period for the previous class, data analysis by the National College Attainment Network shows.

“The data on FAFSA completion takes a bad story and makes it even worse,” said Bill DeBaun, a senior director at NCAN, which tracks FAFSA applications.

Reyna, the Michigan student, submitted her FAFSA form in January, but it wasn’t processed until late March. She was accepted to several schools, but the FAFSA system wouldn’t let her add them to her application, so she gave up on trying to get financial aid from them.

Ava James, 17, from California, faced different, but still frustrating, hurdles. When she tried to add her mother’s first name, Janice Cheryl, the system could not process the double name. She eventually figured it out, but then the system prematurely submitted the form without her signature. It took her six weeks to fix it.

Another wrinkle has been the form’s convoluted language.

Vanessa Farris, a counselor for the Ayers Foundation Trust in McMinnville, Tenn., said several of her students tripped over one particular question:

“Are the student’s parents unwilling to provide their information, but the student doesn’t have an unusual circumstance, such as those listed in question 7, that prevents them from contacting the parents or obtaining their information?”

“Such a little thing, but it has a cost,” Ms. Farris said. Several students provided wrong answers, and they were not able to amend their mistake for months.

The debacle affects some more than others. Agnes Cesare, a college counselor at U.C.L.A. Community School, said she was worried about its effects on students from low-income families or racial minority groups — the ones the new form was meant to help.

Ms. Cesare said that because of the arduous process, some students at her school had decided to pursue an associate degree and save up for a bachelor’s later. But she worries that once they are out of high school, they may not get the help they need to transfer to a four-year school.

“It feels like the roadblocks are insurmountable” for those students, Ms. Cesare said.

The process has been especially difficult for students with undocumented parents. The new system asks parents for their Social Security numbers, which undocumented people don’t have.

That was the case for Elizabeth Templos-Galindo, a 17-year-old in Tennessee, and her parents. They called the Education Department for assistance but were put on hold for five hours before learning of other forms of identification her parents could submit.

Education Department officials have acknowledged the glitches, and on a recent call with reporters, the deputy secretary of education, Cindy Marten, said they had been “working tirelessly to resolve those issues.” Officials added that students were now able to make corrections to their forms and that updated financial records were being sent to schools. Last month, the department announced that the leader of the Federal Student Aid office, Richard Cordray, would step down.

While FAFSA is used by every school in the country, a small group of institutions — a lot of them private and elite schools with a larger endowment and more students from wealthier backgrounds — also uses the College Scholarship Service Profile, a financial aid application administered by the College Board.

The CSS profile costs $25 per application, and schools that use it provide aid estimates using a different formula. Because that form didn’t have a bevy of glitches, students received estimates more quickly from CSS-affiliated schools than ones that use FAFSA.

Owen Keller, 18, from Maine, can speak to that. He filled out both FAFSA and CSS forms in December, and received tuition details from CSS-affiliated schools like Bowdoin College well before his first FAFSA package arrived in late April. Owen decided on Bowdoin even before receiving all of his packages.

The FAFSA blunder has made some reconsider their plans.

Yajaira Vargas, 18, from Reno, Nev., wants to study political science and become an immigration lawyer. She got into her top choice, the University of Nevada, Reno, but wasn’t able to apply for aid until May.

Now, she is considering not going to college immediately and taking a gap year. “But I don’t want to do that,” she said.

Universities are also feeling the stress of the FAFSA disaster, said Christopher Murr, assistant vice president for financial aid and scholarships at Texas State University.

“I know the U.S. Department of Education is doing their best at this point,” Dr. Murr said, “but it seems every couple of days there’s a new wrinkle, a new challenge that we have to adapt to.”

Experts are worried things may get worse this summer, when this debacle could collide with the “summer melt”: a period when students who took all the necessary steps to go to college, including putting down a deposit, decide not to enroll by fall semester.

Because of that, Mr. DeBaun said June 30 was seen as a crucial milestone, when the school year ends and high school students will no longer get access to counseling.

“Will we be able to connect students with the assistance they need to finish the process out?” he asked.

Alan Blinder contributed reporting.